Transparency International’s 2025 Corruption Perceptions Index (CPI) delivers a clear warning to organisations operating across the Asia Pacific region: corruption risks remain deeply embedded, governance pressures are increasing, and expectations on corporate conduct are tightening worldwide.

For mining, engineering and infrastructure firms, particularly those operating across borders, engaging third party agents, or working on projects funded by institutions such as the Asian Development Bank (ADB) or World Bank, the implications of the CPI are not academic. They go directly to legal exposure, reputational risk and board accountability.

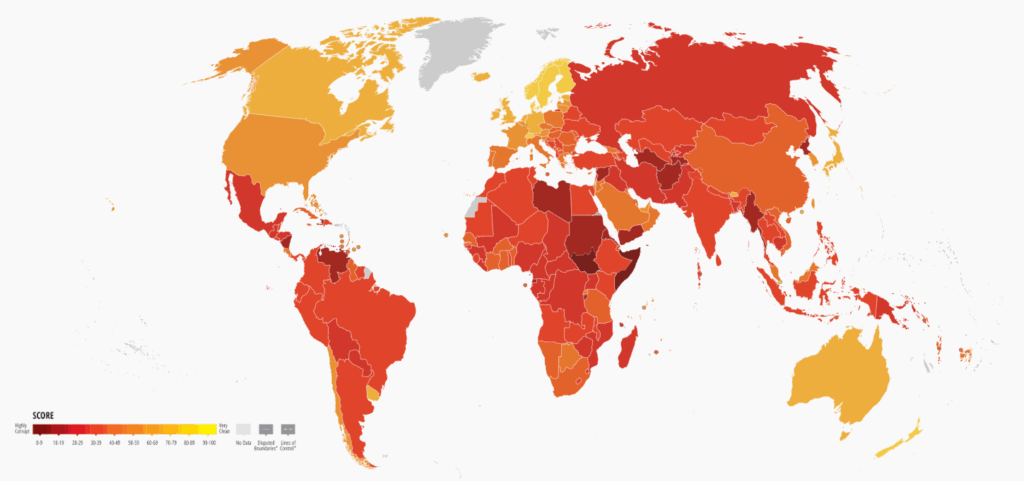

Below is the official CPI 2025 global map published by Transparency International, illustrating relative levels of perceived public sector corruption worldwide.

Corruption Perceptions Index 2025 – Global Overview Map. Source: Transparency International, Corruption Perceptions Index 2025

Understanding the 2025 Corruption Perceptions Index

The Corruption Perceptions Index is the world’s leading global indicator of perceived public sector corruption, ranking 182 countries and territories on a scale from 0 (highly corrupt) to 100 (very clean). It draws on data from 13 independent sources, including multilateral development banks, risk consultancies and business surveys.

In 2025, the findings were stark:

- The global average score fell to 42, the lowest level in over a decade

- More than two thirds of countries scored below 50, indicating widespread governance failures

- Only five countries globally now score above 80, down from 12 a decade ago

Transparency International has highlighted a growing “leadership gap” on anti corruption, even in countries previously seen as strong performers. Some traditional trading partners of APAC organisations have seen a significant drop in ranking over the last two years.

AsiaPacific: Persistent Risk and Rising Public Pressure

The Asia Pacific region recorded an average CPI score of 45, reflecting a decade of stalled or limited progress in tackling corruption. While Singapore (84), New Zealand (81) and Australia (76) continue to perform relatively well, many countries critical to global supply chains remain high risk environments.

Transparency International points to:

- Weak law enforcement and limited accountability

- Opaque political and procurement systems

- Shrinking civic space and pressure on media and whistleblowers

These conditions have contributed to public unrest, political instability and increased scrutiny of government business relationships in several APAC jurisdictions.

For organisations operating across the region, the CPI reinforces a critical reality: corruption risk is systemic, not incidental, and must be managed accordingly.

Why Mining and Engineering Firms Face Elevated Corruption Risk

Mining, oil and gas, engineering, and infrastructure companies consistently face higher inherent corruption risk due to the nature of their operations. These resource businesses, particularly in the oil and gas sector, encounter complex regulatory environments and significant government touchpoints, increasing exposure to bribery and corruption risks. Common risk factors include:

- High value capital projects requiring licences, permits and approvals

- Extensive interaction with government officials and state owned entities

- Reliance on local agents, contractors and joint venture partners

- Operations in remote or low governance environments

The CPI shows that many jurisdictions central to resource extraction and infrastructure development continue to score poorly on perceived corruption. For companies bidding on or delivering projects funded by the World Bank or Asian Development Bank, the consequences of corruption allegations can be severe, ranging from investigations to cross debarment from future projects globally.

Australia’s “Failure to Prevent Bribery” Offence: A Wake-up Call for Boards

Against this backdrop, Australia has fundamentally reshaped its anti bribery and corruption framework. The Crimes Legislation Amendment (Combatting Foreign Bribery) Act 2024 introduced a new corporate offence of “failure to prevent foreign bribery”, which commenced in September 2024.

Under this offence:

- A company can be criminally liable if an associate (including employees, agents, contractors or subsidiaries) bribes a foreign public official

- No intent or knowledge is required on behalf of the organisation or leadership. The offence is one of absolute liability.

- The only defence is demonstrating that the organisation had adequate procedures in place to prevent bribery

Penalties can be substantial, including fines of up to 10% of annual turnover or multiples of the benefit obtained.

What This Means for Senior Leaders

For boards and senior executives, this represents a decisive shift. Anti bribery and corruption controls are no longer a “compliance overlay” – they are now a core governance obligation.

Regulators will expect boards to demonstrate:

- Clear tone from the top on ethical conduct

- Robust corruption risk assessments across jurisdictions and projects

- Active oversight of third party and joint venture risks

- Evidence that controls are implemented, tested and effective

- Staff training programs that are relevant, regular, and reportable

Why Staff Training is Central to “Adequate Procedures”?

One of the most consistent themes in regulatory guidance is the importance of effective, practical training. Having policies on paper is not enough – organisations must be able to show that employees understand how bribery risks arise in real world scenarios and know how to respond.

Training is particularly critical for:

- Staff operating in high risk jurisdictions

- Procurement, project delivery and business development teams

- Executives and directors with oversight responsibilities

GRC Solutions’ Anti bribery and Corruption training courses are designed to help organisations meet these expectations.

The courses focus on:

- Translating legal obligations into practical, scenario based guidance

- Addressing sectors specific risks faced by mining and engineering firms

- Building confidence to identify red flags and escalate concerns

- Supporting a defensible “adequate procedures” framework

Well-designed training not only reduces risk, it also provides tangible evidence of a proactive compliance culture. Solid compliance reporting on compliance training will be essential to defending any action brought against your organisation for failing to prevent bribery.

Turning CPI Insights into Action

The 2025 Corruption Perceptions Index is a clear call to action and a powerful communication tool for leadership in embedding ethical cultures and raising awareness of the risks of bribery and corruption.

For organisations operating across APAC or globally, particularly in high risk sectors, the message is unambiguous:

- Corruption risks remain high

- Enforcement actions and the cost of breaches is increasing

- Regulators expect organisations to implement proactive measures

- Boards and executives are directly accountable

In light of shifting risk profiles among traditional trading partners, organisations should undertake a thorough risk assessment of their current and proposed supply chain and other business relationships. This process will help identify emerging vulnerabilities and ensure that suppliers and business partners continue to meet compliance standards, particularly for APAC businesses operating in or exposed to high-risk jurisdictions.

Proactive evaluation now can mitigate potential exposures before they escalate into major issues. Organisations that invest now in robust governance frameworks, targeted training and strong leadership will be far better placed to navigate this environment with confidence.